Support VPT

Your support helps safeguard the landmarks that tell the story of Martha’s Vineyard’s rich history and heritage. The Trust is a tax-exempt and non-profit organization supported entirely by public contributions and the management of our historic properties. All gifts are fully tax-deductible—Tax Exempt #04.6387676.

Thank you for your generous support.

Other Ways to Give

Make the most convenient impact for you: Donor-Advised Funds, IRA Distribution, Tribute Gifts for a loved one, and more.

‘Friends Of’

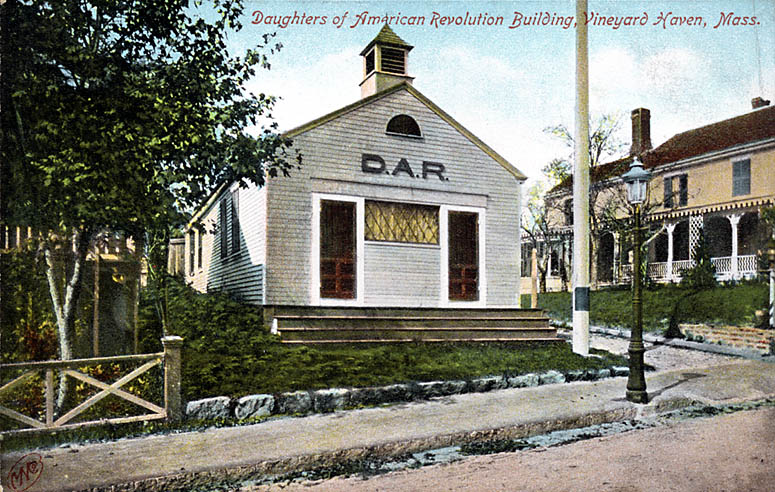

Support a landmark you love – Flying Horses, Union Chapel Grange Hall, or one of our other 17 landmarks across the island.

Matching Gifts

Maximize your impact by having your employer double your donation, making it an easy way to support the causes you care about even more.

Legacy Society

Include a gift to Vineyard Preservation Trust in your will to protect the island’s history for the next generation.

20 Iconic Landmarks

We invite you to read our 2023 Annual Report to learn how your support furthers our mission to preserve the island’s most iconic historic landmarks.

Thank you for being a valued member of our community!

Friends Of

Supporting a specific landmark ensures your funds are spent on its care.

Benefits to the landmark:

- Name acknowledgment on our website.

- Reduce your Estate Tax Liability

Benefits to the landmark:

- Earmarked income that will fund improvements.

- Ensure your favorite landmarks are here for future generations.

Click the picture of the property of your choice – select the ‘I wish to support’ dropdown on the form.

Legacy Society

Leave your Legacy.

With gift planning with a gift from your will, you can provide long-lasting support for our organization while enjoying financial benefits for yourself. Giving to the Trust can be done directly or through a gift model that can provide tax benefits and income, such as Bequests, IRA Rollover, Endowment Gifts, and Beneficiary Designation Gifts such as retirement or life insurance policies.Have questions? Please get in touch with us:

Nevette Previd, Executive Director

508–627–4440 x 115

nevette@mvpreservation.org

By Mail:

Vineyard Preservation Trust

Post Office Box 5277

Edgartown, Massachusetts 02539

(Tax Exempt #04.6387676)

Tribute Gifts

Make a gift in honor or memory of a loved one.

Donate in memory of a friend or loved one or in memory of a beloved pet or person who has passed on. We will notify the family of the honoree of your gift with a card. Click the button and select your wish on the form.

Donate Now

Other Ways to Give

Making an impact that is most convenient for you.

Every donation counts. We accept all forms of gifts, this includes:

- Donor-Advised Funds

- Cash equivalents, such as checks, wire transfers, or cash positions from a brokerage account

- IRA qualified charitable distributions

- Publicly traded securities or mutual fund shares

- Restricted stock

- Private equity and hedge fund interests

By Mail:

Vineyard Preservation Trust

Post Office Box 5277

Edgartown, Massachusetts 02539

(Tax Exempt #04.6387676)

Have questions? Please get in touch with us:

Nevette Previd, Executive Director

508–627–4440 x 115

nevette@mvpreservation.org

Matching Gifts

Maximize your impact with corporate matching gifts. Your donation can be doubled by your employer, making it an easy way to support the causes you care about even more.

Step 2: Make a donation to Vineyard Preservation Trust through our website or by mail. You will receive a receipt that you can give to your employer.

Step 3: Submit a matching gift request to your employer. They may require some basic information about Vineyard Preservation Trust, which you can find below.

By Mail:

Vineyard Preservation Trust

Post Office Box 5277

Edgartown, Massachusetts 02539

(Tax Exempt #04.6387676)